Are you looking to secure a car loan but concerned your credit score might have an impact on what options are available to you? Many of us will be aware that our credit rating will influence our access to borrow money, particularly for high-worth loans such as for a car. You might be wondering how to get a car finance deal with bad credit. The great news is that it is possible.

We’ll guide you through some of the ways you can access financing deals for cars even if you don’t have a shining credit score. From explaining what a credit score is to applying for a car loan with poor credit scores and tips to improve your chances of getting car finance with bad credit, we’ll help navigate some of the questions that often come up.

What is a credit score?

You know a good credit score is what we all want to be aiming for, but what is it, and what does it mean? A credit score, sometimes called a credit rating or credit report, is a financial footprint of sorts. It helps inform lenders about the risk of loaning funds to you so they can decide whether to lend to you or at what interest rate.

Your credit rating can be affected by previous repayment history, whether you’ve declared bankruptcy or whether you’ve missed repayments on previous loans. It’s important to know that not all ‘bad’ credit is the same. If you are young or have a limited history of borrowing money, then you will likely have a lower credit score. It takes time to earn a good credit rating, and we’ll include some tips below for how to improve your credit.

What is bad credit car finance?

You might have heard the term ‘bad credit car finance’ before and wondered what it means. It’s a specific type of loan designed for people with a bad or limited credit history who might not otherwise be able to borrow money. There are several different types of financing options for those with poor credit, including:

- Personal loan – These often come with a higher APR but still allow you to borrow money

- Secured loan – Usually, your house is used as collateral to show you are serious about making repayments

- Guarantor loans – When a family member or friend confirms they will repay the lender if you default on the loan

How to apply for a car finance deal with bad credit

It’s good to know that even if you do have bad credit, it is still possible to apply for a car finance deal. It will likely just mean that it’s more expensive than if you have good credit. Bad credit deals can also cover those with limited credit history, where there isn’t enough information to provide a full picture of the risk for a lender.

There are lenders that specialise in offering bad credit loans, so choosing one of these lenders is likely to give you a better selection of borrowing options suitable for your credit score. It’s important to ensure you’re fully informed when you start applying for a bad credit car finance deal by understanding your financial position and current credit score before you begin the process.

Tips for improving bad credit

- Register to vote – Lenders need to verify your name and address; if you’re on the electoral roll, this can confirm your details.

- Find problems and address them – Obtain a full credit history and determine which areas are impacting your score. Double check there are no mistakes and see where you can improve or fix issues.

- Always make repayments on time – If you’re currently paying off debt, ensure you are not late and don’t miss any repayments. By keeping up to date with payments, you show lenders you are responsible, and this is more likely to help you secure a better loan.

- Avoid connections with other people with poor credit – If you’ve been financially linked to someone else that has a poor credit history, it could be lowering your credit score. Whether a joint bank account or a mortgage, it’s important to issue a notice of disassociation which will ensure you’re no longer financially linked to that person.

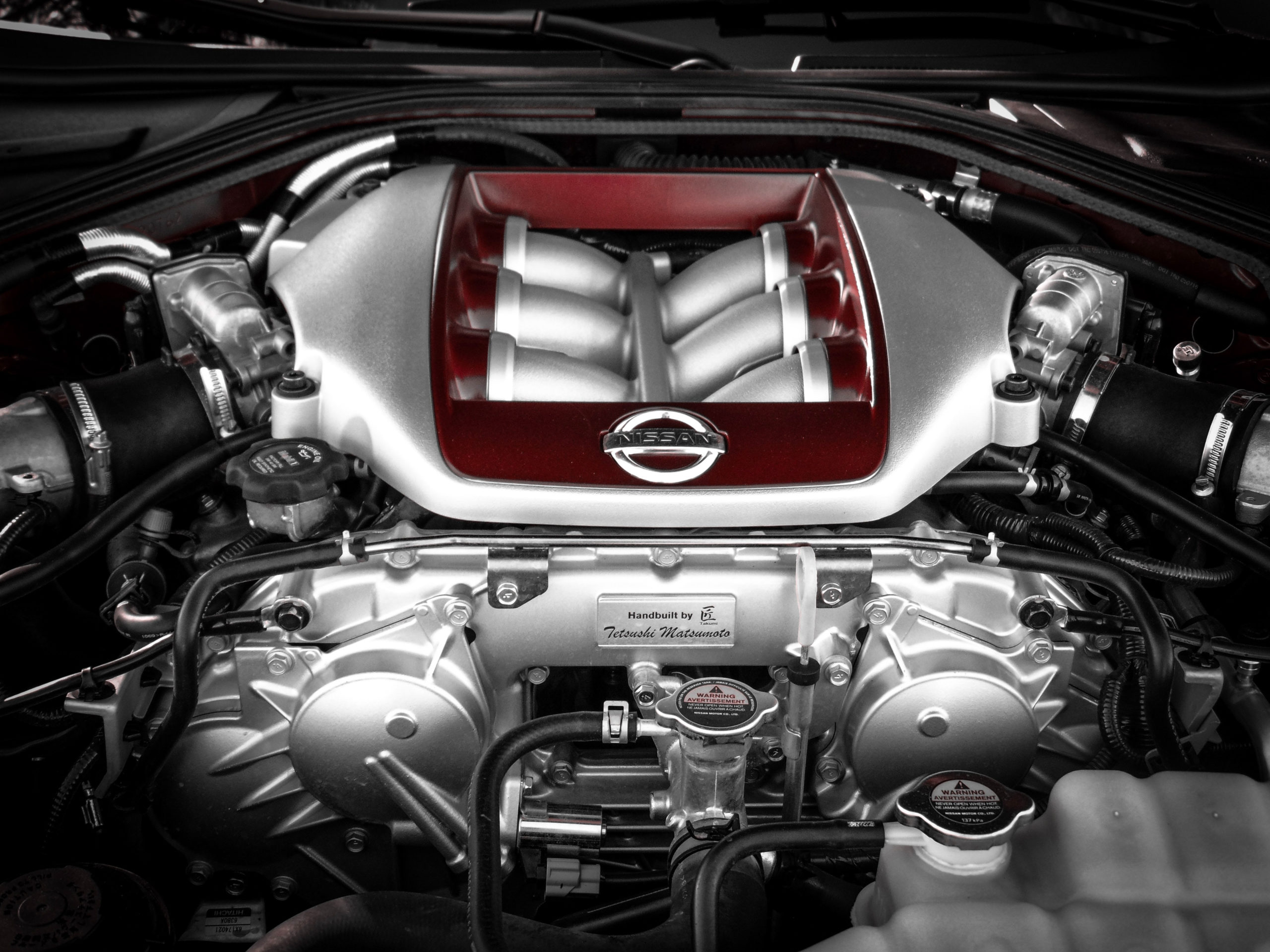

Your checklist before you buy

Once your finance has been approved, and you know your budget, it’s vital to complete some checks before you make a purchase. We recommend every buyer to check the following:

- How many previous owners there have been

- Whether the number plates have been changed

- It has a fully checkable MOT history

- If it’s an import or export

It’s good to have an indication of the vehicle you’re looking at before you apply for finance, as lenders will want as much information as possible. To get a clear picture, why not complete a used car check with us for free?

We compare the UK’s top car finance lenders so you don’t have to!

Zero deposit available and we can get you approved – fast!

- Low APRs from 5.9%, saving £1,155 on average

- Apply online in 2 minutes

- Click and Collect and Delivery Available

- Instantly show your eligibility with some of the market’s top lenders

Frequently Asked Questions

The most common types of car finance agreement are hire purchase (HP), personal contract purchase (PCP), lease purchase or personal loan, though other options are available also.

Bad credit history can make it more difficult to obtain car finance but it certainly isn’t impossible. There are car finance providers that do provide car finance to people with bad credit history.

The cheapest option to buy a car is using your own savings while personal loans are typically the cheapest way to borrow to buy a car.