Company cars have long been, and remain, a great employee benefit and an incentive to attract top talent to your business. As a business owner getting yourself a company car can also be a very attractive perk. There are tax advantages and disadvantages to company cars depending on use and your position. Employers and business owners need to consider how using a company car impacts them from a tax perspective, how VAT plays a role in the type of vehicle you choose, and whether to buy or lease a car.

We’ve helped over 700,000 drivers

the better way to get into a car

Enter the reg of your car and we’ll do the rest.

Enter your reg

Do you know the price?

Leave blank and we’ll provide a FREE live market valuation.

The only place you can compare buying, leasing, and subscription deals from across the market.

Personal Use

It is really important to understand from the outset what personal use is because it comes up a lot when considering company vehicles. If a company car is used for anything other than work travel it can count as personal use. This doesn’t not include commuting, while it can seem like work travel it is generally considered as personal use.

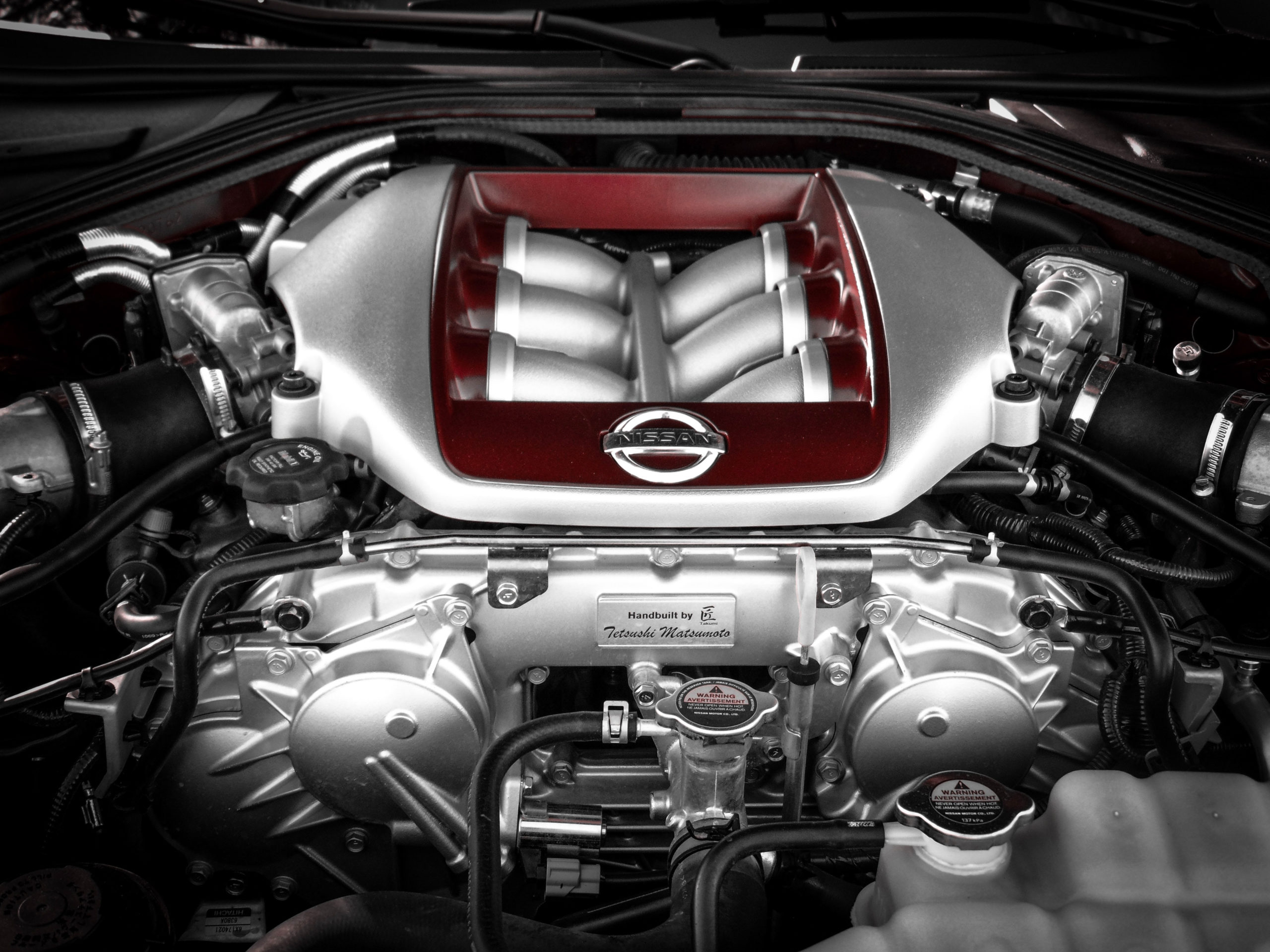

Company Cars and VAT

It’s important to know how cars and other vehicles differ when it comes to VAT, as in most cases, a VAT-registered business won’t be able to reclaim VAT when they buy a car. However, if it’s a commercial vehicle, then it’s possible to reclaim the VAT on the purchase. If employers charge employees for the use of the car, they do not account for VAT.

There are strict guidelines as to what constitutes a car fit for VAT purposes – for example, special purpose vehicles such as mobile shops or breakdown recovery vehicles don’t count as business vehicles where VAT is concerned. Likewise, motorcycles, vehicles with a payload of over one tonne, and vehicles capable of accommodating just one person also don’t count for VAT purposes.

However, if you’re planning on purchasing a van through your business, you’ll be exempt from these limitations, as HMRC allows for insignificant levels of private use, so it can be used to commute to and from work providing it’s primarily used for commercial purposes.

Benefit in Kind

If you own a business and are looking for a company car or you would like to organise a company car for some employees then it is really important to understand benefit in kind (BIK). For cars that are used purely for work use this isn’t an issue but if the car is used for personal use it will result in a taxable benefit in kind, which is based on the value of the car when new (not necessarily how much you paid for it).

This can be an issue because most business owners looking for a company car fully intend to use it for personal use as do most employees. The BIK rates are much higher these days than they once were which is one of the reasons company cars are in decline as a perk. The BIK is also based on the emissions so hybrids incur a lower rate and fully electric vehicles are very low indeed. These rates may increase over time but they are around 1% in 2021.

BIK can make a company car very costly if you are looking at traditional fuels but with the rise of choices in the EV world things could be changing.

Company Pool Cars

If you’ve purchased a car to be used as a pool car within the company, you can claim the VAT on this as well, providing it:

- Is normally kept overnight at the place of work (and that this isn’t also your home)

- Isn’t allocated to one individual

- Is generally available for all staff working for the business

Private Vehicles for Business

If you use your private car for business, you can claim VAT on the fuel used, but you need to be clear about what fuel was used for business and what was used privately. The simplest way is to claim VAT on all fuel used in the car, and then pay a Road Fuel Scale Charge for each VAT period, which is based on the CO2 emissions. However, you can, of course, keep detailed mileage records to show how much business and private mileage you’ve done as well.

Leasing a Business Vehicle

When it comes to leasing a commercial vehicle, businesses can typically claim 50% of the VAT or all, if you can provide evidence that the car isn’t used for personal use. The decision whether to buy or lease a vehicle depends on how you plan to pay for it – investing the money to buy may not make sense for your business, in which case leasing could be a more cost-effective solution than purchasing outright.

If you’re leasing a car, the business won’t own it so you can’t claim capital allowances. But you can claim it as a business expense, providing the CO2 emissions are below 130g/km, which enables you to pay for 100% of the monthly leasing costs through the business profits. In instances when the emissions are higher than this, you can claim 85% of the expense.

Final thoughts

A company vehicle is a great benefit to staff, and it can be an incentive for attracting employees too. But it’s important to be clear about the financial implications of buying and leasing a company vehicle, and how the tax rates will be affected depending on the type of vehicle you choose and whether it’s used solely for business.

Car Guide are soon to launch a new tool that will also enable you to compare lease deals with PCP and options to buy outright, so you can find the best deal for your next company car.